The Edge Imbalance - A New Order Flow Indicator By Cignals

Unfinished Auctions (UFA) don't work quite the same way for crypto as they do for equities and commodities futures, where they were developed and traditionally used.

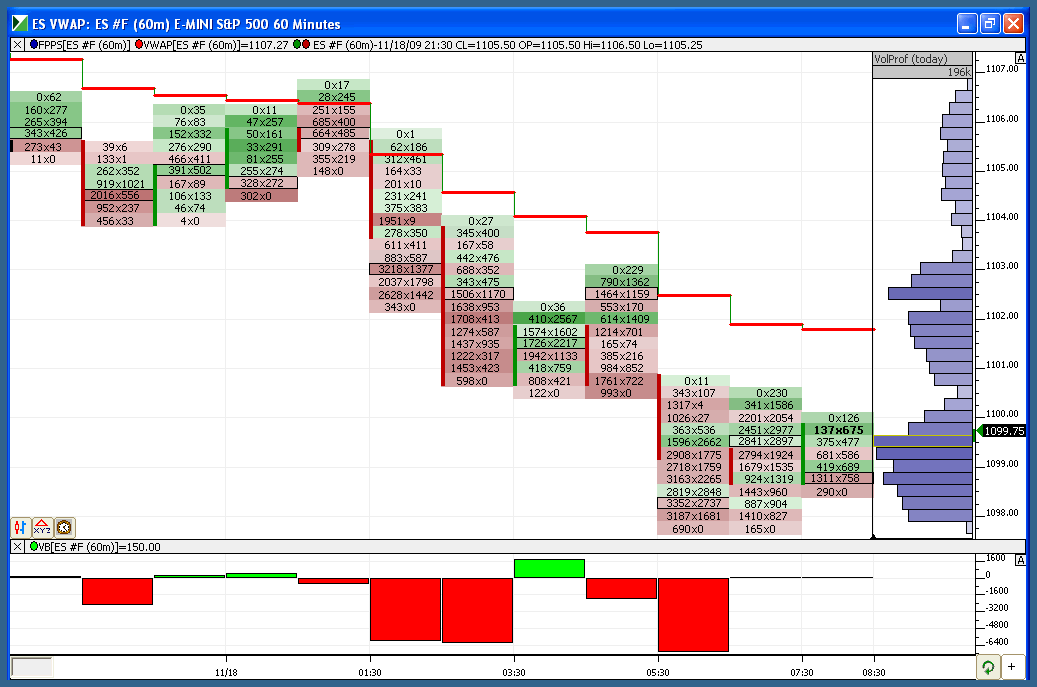

Unfinished Auctions are a phenomenon first noticed by traders in traditional finance several decades ago. In 2003, software company Market Delta introduced this concept to screen traders with their proprietary charting platform. Market Delta defined an Unfinished Auction as a cluster of prices in a time period where buyers and sellers had not yet completed all the activity in a range (auction), thereby leaving the price free to continue a trend. These UFAs work very well for futures contracts on financial instruments such as the S&P 500 (ES) and NASDAQ 100 (NQ), and single stock shares (such as AAPL, TSLA, AMZN). The reason for this is very simple: all markets at their core are just auctions between entities with inventory (holding stock/futures) and other entities with demand for that inventory (wanting to buy stock/futures). Due to the inherent nature of securities and futures, there are a lot of regulated contract parameters such as minimum tick size, specific exchanges where the shares or futures trade, buy/sell minimums, etc. For example, normally a trader is required to buy or sell at least one share of a company while trading through traditional brokerages to execute. The same applies to futures contracts, a trader must buy or sell at least one futures contract at a minimum for the trade to be accepted and executed, and that contract may be for a significant quantity of the underlying product.

Newer brokerages like Robinhood enable users to split shares into fractions, however, this is atypical and not indicative of how traditional assets are traded. The strong standardization gives traders a very clear picture of how the multiple forces involved in the auction process react when the price reaches certain levels. Traditionally, if we see both buyers and sellers at the top or bottom of a cluster, the auction is said to be “unfinished.” When this state occurs, the market forms a price magnet that will be revisited at some point in the future as the auction process eventually resolves itself. Due to the high degree of standardization, depth, and institutional presence in traditional markets, these anomalies seldomly occur, as most auctions are orderly and tend to be completely finished on the clusters, (ie); all business being done on the ask at the top of a cluster, and all business is done on the bid at the bottom.

BitMEX changed the game when it introduced perpetual cryptocurrency futures. Perpetual futures aren’t a new concept; they were first proposed back in 1992 by economist Robert Shiller to enable derivative trading for illiquid assets. However, this was largely ignored by the mainstream finance community. Arthur Hayes revived this concept in 2016 and applied it to leveraged Bitcoin trading on BitMEX. If you think Bitcoin and other cryptocurrencies are illiquid in today’s era, I can assure you, they were much more so back then and suffered from extremely violent swings as a result. Cignals was founded in late 2016, shortly after Arthur launched the first perpetual futures contracts on BitMEX. We were experimenting with our own proprietary trading algorithm to take advantage of the new leveraged perpetual futures for Bitcoin. It was a great way to hedge spot Bitcoin exposure as well as earn Bitcoin-on-Bitcoin returns with minimal margin requirements, unlike traditional finance which required large margin requirements on futures contracts. We attempted to apply some of the order flow, volume profile, and auction market theory principles that served me so well during my time as a prop trader & money manager on Wall Street. Naturally, we started to explore the unfinished auction phenomenon to find organic support and resistance levels, as well as high-probability magnet areas for buying and selling to occur. However, we soon discovered some interesting anomalies due to the lack of standardization in crypto markets, compared to TradFi where the concept of UFAs originated.

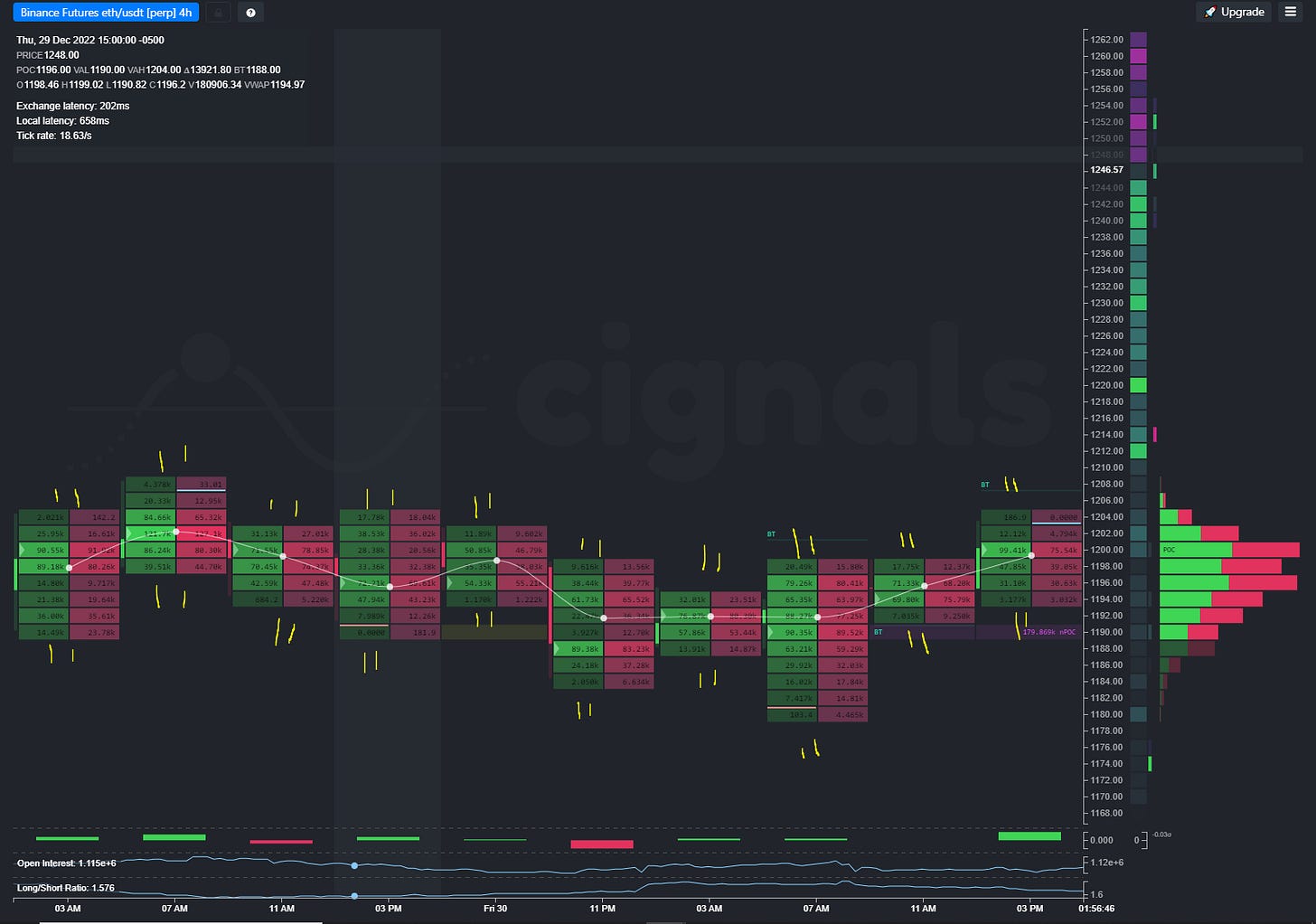

Among the most notable problems were the strange contract mechanics, arbitrage opportunities (again lack of standardization & multiple exchange venues), high degree of machine/algorithmic traders compared to screen traders, tick sizes, pricing model, lack of expiration (compared to TradFi futures), extremely thin liquidity (compared to TradFi futures), and the overall market manipulation that BitMEX was known for. Shortly thereafter, we began to notice that in almost every single cluster, regardless of the time frame we deployed CM1 (our first algorithm), it resulted in an unfinished auction as traditionally defined, on the top and bottom of a cluster. This was also prior to Cignals having the UI/UX our users are now accustomed to. After thousands of hours spanning years of screen time & studying, tinkering/fine-tuning of CM1, and trial/error, we realized something extremely important that separated the crypto industry from TradFi.

Aggregation of cryptocurrency trades at higher levels changes the underlying mechanics behind the phenomenon as first noticed by MarketDelta in 2003. Instead of a minority of clusters presenting UFAs, and thus, being a good signal for developing trade ideas, a majority of clusters were now presenting the phenomenon, removing any alpha we were expecting. Fortunately, we pioneered a novel approach to standardize some of what was so clearly different about these new contracts, and from there, the concept of the Cignals charting platform was born. It was (and still is) essentially what our bot sees and uses as logic to make trades. The major difference is that the information is displayed nicely and neatly for existing prop traders to use in their screen trading as they made the switch over from TradFi to crypto markets. One thing that separates Cignals from many other charting products is that we use raw tick-level data. We never repurpose previously aggregated data like the vast majority of our competitors. This is why you may see some other services offer “UFAs” for crypto that appear seldomly, which is not the case for crypto markets when utilizing raw ticks.

As a result of our discovery, these crypto-specific UFAs play out with near-perfect regularity in virtually every time frame. It’s astonishing how regularly these levels attract price back to them to complete the auction process & resolve the imbalances created (as our veteran users are already aware of). This is a result of a significant imbalance forming at the edge of the cluster once the auction process comes to an end, leaving behind excess liquidity in certain cases, which is similar to how traditional UFAs work. Obviously, the lower the time frame, the noisier it gets, and the least amount of weight is put on these levels. We noticed there are many conflicting resources on finished auctions as well as the UFA phenomenon now being propagated with the proliferation of new order flow websites. Many explanations quite literally contradict themselves on the same page, and some are actually copied verbatim from other websites with no real thought or original development put into the writing of these concepts.

Today we’ve decided to re-launch the indicator we previously labeled as UFA to “Edge Imbalance” in order to make this novel idea abundantly clear. While we consider our version a true UFA optimized for the complexities and specifics of the crypto markets, it’s likely simpler to rename the indicator so that we do not add to the widespread confusion in the cryptocurrency trading community. Please keep in mind, this is a name change only! The behavior will be exactly the same, so if you’ve developed strategies based on our proprietary UFA indicator, nothing will change other than the name! We want to be clear about what we’ve developed and differentiate it from the “me too” copies that are proliferating in today’s trading community. Cignals prides itself on being at the bleeding edge of order flow, volume profile, and auction market theory tools for cryptocurrency traders. We will continue to educate our users and innovate with new and highly unique features that will further set us apart from the pack. Collectively, our founders have almost 40 years of combined experience in their respective fields, so we have much more to offer everyone as we continue to grow! We love and appreciate you all, and look forward to serving you in 2023 and beyond with new features that we know you will love!

great explanation and a good read!